控制世界的人有多少|最後的警鐘

How Few Control the World

控制世界的人有多少|最後的警鐘!- 準備轉變 / 2022年1月23日

Who is who sharing the Covid Pandemic Profit?

誰在分享Covid大流行的利潤?

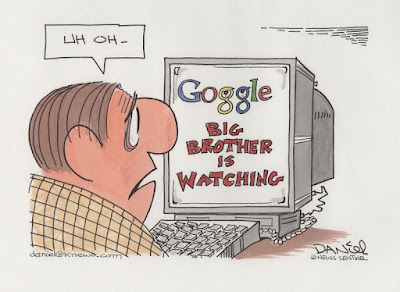

Big Brother is Watching You

老大哥在監視你

Who really control the world? Systems analysts say it is a unique effort to untangle control in the global economy. And to find out who those really are; The Illuminati? Freemasons? The Bilderberg Group? Or are these all red herrings to distract your prying eyes from the real global elite? The answer, like most topics worth exploring, is not quite so simple. Have no doubt, there are secretive global powers whose only goal is to keep and grow that power. But it really may not be as secretive as you’d think. And that’s what makes it even more criminal…

誰真正控制了世界?系統分析師表示,這是解開全球經濟控制之謎的一次獨特努力。並找出那些真正的人是誰;光照派?共濟會?彼爾德伯格俱樂部?或者這些都是轉移你對真正的全球精英的注意力的紅鯡魚?答案,就像大多數值得探討的話題一樣,並不是那麼簡單。毫無疑問,一些神秘的全球大國的唯一目標就是保持和發展這種力量。但是它可能並不像你想像的那麼神秘。這就是為什麼它更具有犯罪性..。

“Facts do not cease to exist because they are ignored.”

“事實不會因為被忽視而不復存在。”

~Aldous Huxley

~奧爾德斯 · 赫胥黎

And, Henry Ford once quipped;

還有,亨利 · 福特曾經打趣道;

“It is well enough that people of the nation do not understand our banking and money system, for if they did, I believe there would be a revolution before tomorrow morning.”

“全國人民不了解我們的銀行和貨幣體系就已經足夠了,因為如果他們了解,我相信明天上午之前就會發生一場革命。”

Every major geopolitical decision of the last five decades has been run through one of these four organizations: the Bilderberg Group, the Trilateral Commission, the Council on Foreign Relations and the World Bank/International Monetary Fund (IMF).

在過去的50年裡,每一個重大的地緣政治決策都是通過以下4個組織中的一個來執行的:彼爾德伯格俱樂部銀行、三邊委員會銀行、外交關係委員會和世界銀行/國際貨幣基金組織。

While the Trilateral Commission excludes anyone currently holding public office from membership, the – global who’s-who of power brokers – serves as a revolving door of the rich and powerful from the financial, political and academic elite.

雖然三邊委員會不允許任何現在擔任公職的人成為黨員,但全球權力掮客中的權力人物就像是一扇旋轉門,把金融、政治和學術精英中的有錢有勢的人拒之門外。

For the Financial Elite follow the money – Systems theorist James B. Glattfelder sheds light on the dark corners of bank control and international finance with his scientific process analysis and pulls some of the major players out of the dark.

金融精英追隨貨幣系統理論家詹姆斯• b •格拉特費爾德(James b. glatfelder)的科學過程分析,揭示了銀行控制和國際金融的黑暗角落,並將一些主要參與者拉出了黑暗。

“From a massive database of 37 million companies, Glattfelder pulled out the 43,060 transnational corporations – companies that operate in more than one country – that are all connected by their shareholders. Digging further, he constructed a model that actually displays just how connected these companies are to one another through their ownership of shares and corresponding operating revenues.”

“格拉特費爾德從3700萬家公司的龐大數據庫中抽出了43060家跨國公司——這些公司在一個以上的國家經營——這些公司都是由其股東聯繫起來的。進一步研究後,他構建了一個模型,實際上顯示了這些公司之間通過持有股票和相應的營業收入相互聯繫的程度。”

Only 1318 transnational corporations form the core of the economy. In attached graphic, the Super connected companies are red, very connected companies are yellow. The size of the dot represents revenue.

只有1318家跨國公司構成了經濟的核心。在附圖中,超級連接的公司是紅色的,非常連接的公司是黃色的。點的大小代表收入。

Above image is a chilling one that looks like some sort of intergalactic light globe. Glattfelder has done a remarkable job of boiling these connections down to the main actors — as well as pinpointing how much power they have over the global market. These “ownership networks” can reveal who the key players are, how they are organised, and exactly how interconnected these powers are. From New Scientist:

上面的圖片是一個令人毛骨悚然的,看起來像某種星系間的光球。格拉特費爾德在把這些關係歸結到主要參與者方面做了出色的工作,並精確指出了他們在全球市場上有多大的影響力。這些“所有權網絡”可以揭示誰是關鍵角色,它們是如何組織的,以及這些權力之間的相互關聯程度。來自《新科學家》雜誌:

“Each of the 1318 had ties to two or more other companies, and on average they were connected to 20. What’s more, although they represent 20 per cent of global operating revenues, the 1318 appear to collectively own through their shares the majority of the world’s large blue chip and manufacturing firms — which is the “real” economy — that represents a further 60 per cent of global revenues (GDP).

“這1318家公司每家都與兩家或更多其它公司有聯繫,平均而言,它們與20家公司有聯繫。此外,儘管1318企業佔全球營業收入的20% ,但它們似乎通過各自的份額,共同擁有全球大型藍籌股和製造業企業(即“實體”經濟體)的大部分股份,這些企業還佔全球總收入的60% 。

When the team further untangled the web of ownership, it found much of it tracked back to a “super-entity” of 147 even more tightly knit companies — all of their ownership was held by other members of the super-entity — that control 40 per cent of the total wealth in the network. According to his data, Glattfelder found that the top 730 shareholders control a whopping 80% of the entire revenue of transnational corporations.

當該團隊進一步理清所有權網絡時,發現其中很大一部分可追溯到一個由147家組織更為嚴密的公司組成的“超級實體”——它們的所有權全部由超級實體的其他成員持有——這些公司控制著該網絡40% 的財富總額。根據他的數據,格拉特菲爾德發現,排名前730位的股東控制著跨國公司整個收入的高達80% 。

And — surprise, surprise! — They are mostly financial institutions in the United States and the United Kingdom. That is a huge amount of concentrated control in a small number of hands…

還有——驚喜,驚喜!ー他們主要是美國和英國的金融機構。這是一個巨大的數額集中控制在少數人的手..。

Here are the top ten transnational companies that hold the most control over the global economy – and if you are one of the millions that are convinced Big Banks run the world, you should get a creeping sense of justification from this list:

以下是控制全球經濟最多的十大跨國公司——如果你是千百萬確信大銀行控制著世界的人之一,那麼你應該從這份名單中慢慢找到正當理由:

▪︎ Barclays plc. 巴克萊銀行

▪︎ Capital Group Companies Inc. 首都集團股份有限公司

▪︎ FMR Corporation

▪︎ AXA

▪︎ State Street Corporation 道富銀行

▪︎ JPMorgan Chase & Co. 摩根大通

▪︎ Legal & General Group plc. 法律通用集團有限公司

▪︎ Vanguard Group Inc 萬家集團股份有限公司.

▪︎ UBS AG 瑞銀集團

▪︎ Merrill Lynch & Co Inc. 美林證券公司

Some of the other usual suspects round out the top 25, including JP Morgan, Credit Suisse, and Goldman Sachs. What you won’t find are ExxonMobil, Microsoft, or General Electric, which is strange. In fact, only China Petrochemical Group Company at number 50 is the first company in the row that creates something.

其他一些常見的嫌疑人排在前25名之外,包括摩根大通、瑞士信貸和高盛。你找不到埃克森美孚、微軟或者通用電氣,這很奇怪。事實上,只有排在第50位的中國石化集團公司是第一家創造出東西的公司。

The top 49 corporations are financial institutions, banks, and insurance companies — with the exception of Wal-Mart, which ranks at number 15… The rest essentially just push money around to one another. The interconnectedness of the top players in this international scheme, are:

排名前49位的公司是金融機構、銀行和保險公司——排名第15位的沃爾瑪除外... ... 其他公司基本上只是把錢推來推去。這項國際計劃的頂級參與者之間的相互聯繫如下:

The number one player is Barclays: “Barclays was a main player in the LIBOR manipulation scandal, and were found to have committed fraud and collusion with other interconnected big banks. They were fined $200 million by the Commodity Futures Trading Commission, $160 million by the United States Department of Justice and £59.5 million by the Financial Services Authority for “attempted manipulation” of the Libor and Euribor rates. Despite their crimes, Barclays still paid $61,781,950 in bonuses over that same year, including a whopping $27,371,750 to investment banking head Rich Ricci. And yes, that’s actually his real name…”

排名第一的是巴克萊銀行:“巴克萊銀行是倫敦銀行間同業拆借利率操縱醜聞的主要參與者,被發現與其他相互關聯的大銀行進行欺詐和勾結。商品期貨交易委員會對他們處以2億美元罰款,美國司法部處以1.6億美元罰款,金融服務管理局處以5950萬美元罰款,理由是他們”企圖操縱”Libor 和 Euribor 利率。儘管犯了罪,巴克萊銀行仍然在同一年支付了61,781,950美元的獎金,其中包括高達27,371,750美元給投資銀行主管里奇 · 里奇。是的,這是他的真名... ...”

These are the guys that run the world. “It’s essentially the “too big to fail” argument laid out in a scientific setting — only instead of just the U.S. and U.K. banks, we are talking about an international cabal of banks and financial institutions so intertwined that they pose a serious threat to global economics.” Effectively, instead of “too big to fail,” these are “too connected to fail”…

這些傢伙掌控著世界。“這實質上是在科學背景下提出的“大到不能倒”的論點ーー只不過不僅僅是美國和英國的銀行,我們討論的是一個由銀行和金融機構組成的國際陰謀集團,它們如此相互交織,對全球經濟構成了嚴重威脅。”實際上,這些企業不是“太大而不能倒”,而是“太緊密而不能倒”... ..。

If this information is linked with the ones behind the fake Covid Pandemic specifically Big Pharma involvement, it is getting even more weird;

如果這些信息與造假的大流行疫情背後的人聯繫在一起,特別是大型製藥公司的參與,這就變得更加奇怪了;

Who is Who that Share the Covid Pandemic Profit?

誰是分享 Covid 大流行利潤的人?

A French FWC-reader searched for who is who of shareholders it was found that the main shareholder of Pfizer is Vanguard Group, as listed above in the top 10 league.

一位法國的 fwc 讀者在搜索誰是誰的股東時發現,輝瑞的主要股東是先鋒集團(Vanguard Group) ,如上文所列的前10名。

The main shareholder of Johnson & Johnson is Vanguard Group

強生的主要股東是先鋒集團

AstraZeneca’s 3rd shareholder is Vanguard Group.

阿斯利康公司的第三股東是先鋒集團。

Moderna ’s 4th largest shareholder is Vanguard Group.

摩登的第四大股東是先鋒集團。

The third largest shareholder of Sanofi is Vanguard Group. The 1st shareholder is L’Oréal, but the 3rd shareholder of L’Oréal is Vanguard Group.

賽諾菲的第三大股東是先鋒集團。第一股東是歐萊雅,但第三股東是先鋒集團。

Vanguard Group is an American pension fund. It manages about $ 7 trillion, more than the GDP of France and Germany combined. At the international lobby level, it should have great influence..

先鋒集團是一家美國養老基金。它管理著大約7萬億美元,比法國和德國的國內生產總值加起來還多。在國際遊說層面,它應該有很大的影響力。

And then the supporters of the lobby are:

遊說團的支持者是:

Google with YouTube, Google maps, WhatsApp, etc. with their main shareholder Vanguard Group.

谷歌與他們的主要股東先鋒集團,以及 YouTube、谷歌地圖、 WhatsApp 等等。

The first shareholder of Facebook is Vanguard Group.

Facebook 的第一股東是先鋒集團。

Microsoft’s largest shareholder is Vanguard Group.

微軟最大的股東是先鋒集團。

Apple’s largest shareholder is Vanguard Group.

蘋果最大的股東是先鋒集團。

Vanguard Group is only the 2nd shareholder from Amazon. Basically, GAFAM is the one. So at the lobby level to sell us something, no doubt that is very, very powerful.

先鋒集團是亞馬遜的第二大股東。基本上,GAFAM 是一個。所以在遊說層向我們推銷一些東西,毫無疑問,這是非常非常有力的。

GAFAM is the acronym used to refer to American tech giants Google, Apple, Facebook, Amazon and Microsoft. Together, they hold five of the six top spots in a listing of the world’s most valuable public corporations.

GAFAM 是美國科技巨頭谷歌、蘋果、 Facebook、亞馬遜和微軟的縮寫。在全球最有價值的上市公司排行榜上,它們總共佔據了前六名中的五個位置。

And then, Akamai is the largest shareholder in the Vanguard Group.

此外,Akamai 還是領航投資的最大股東。

Akamai is the world’s largest digital data storage company. It is this company that, together with the national printing office, the data stores of the entire anti-Covid operation and thus also manages the data of the QR code used at all points where it is applied, including the sanitary pass.

Akamai 是世界上最大的數字數據存儲公司。正是這家公司與國家印刷辦公室一起,存儲了整個反掃盲行動的數據,從而也管理了使用該行動的所有地點的二維碼數據,包括衛生通行證。

Further to make people ill, here are some other supporters for that job;

為了進一步使人們生病,這裡還有一些其他的支持者;

MacDonald’s first shareholder is Vanguard Group.

麥克唐納的第一個股東是先鋒集團。

The first shareholder of Coca-Cola is Vanguard Group.

可口可樂的第一股東是先鋒集團。

Disney’s largest shareholder is Vanguard Group.

迪斯尼最大的股東是先鋒集團。

And finally the icing on the cake;

最後是蛋糕上的糖衣;

The first shareholder of Philip Morris is Vanguard Group.

菲利普莫里斯公司的第一股東是先鋒集團。

Philip Morris is the world’s largest tobacco manufacturer. Tobacco kills 8 million people a year with state endorsement. And in countries where it can, its prime target is children. Ironically, one of Pfizer’s most cost-effective drugs is Champix, a smoking cessation drug …

菲利普莫里斯公司是世界上最大的煙草製造商。在政府的支持下,每年有800萬人死於菸草。在可能的國家,它的首要目標是兒童。具有諷刺意味的是,輝瑞公司最具成本效益的藥物之一是冠必克,一種戒菸的藥物..。

What is the risk associated with Champix? The most common side-effects with Champix, seen in more than 1 patient in 10, are nausea (feeling sick), insomnia (difficulty sleeping), abnormal dreams, headache and nasopharyngitis (inflammation of the nose and throat).

與Champix相關的風險是什麼? Champix最常見的副作用是噁心(感覺不適)、失眠(難以入睡)、夢境異常、頭痛和鼻咽炎(鼻子和喉嚨發炎),每10名患者中就有1名以上出現。

The health or vaccination pass with 3 doses at € 19.50 in 6 months for 50 million French people, makes $ 2.975 billion, just for France, for above listed pharmaceutical companies and therefore indirectly for Vanguard Group aided for by Google, Facebook and Phillip Morris.

為5000萬法國人提供3劑19.50歐元的健康或疫苗接種通行證,在6個月內為上述上市製藥公司賺取29.75億美元,因此間接為谷歌、Facebook和菲利普·莫里斯資助的先鋒集團賺取20.75億美元。

Do some homework; and find out who are the main shareholders of Vanguard Group?

做一些功課,找出誰是先鋒集團的主要股東?

視頻:https://youtu.be/R7sQs6aQuuQ

來源:https://finalwakeupcall.info/en/2022/01/22/how-few-control-the-world/

原文:https://www.pfcchina.org/xinrenyuedu/58551.html

留言